INNOVATION

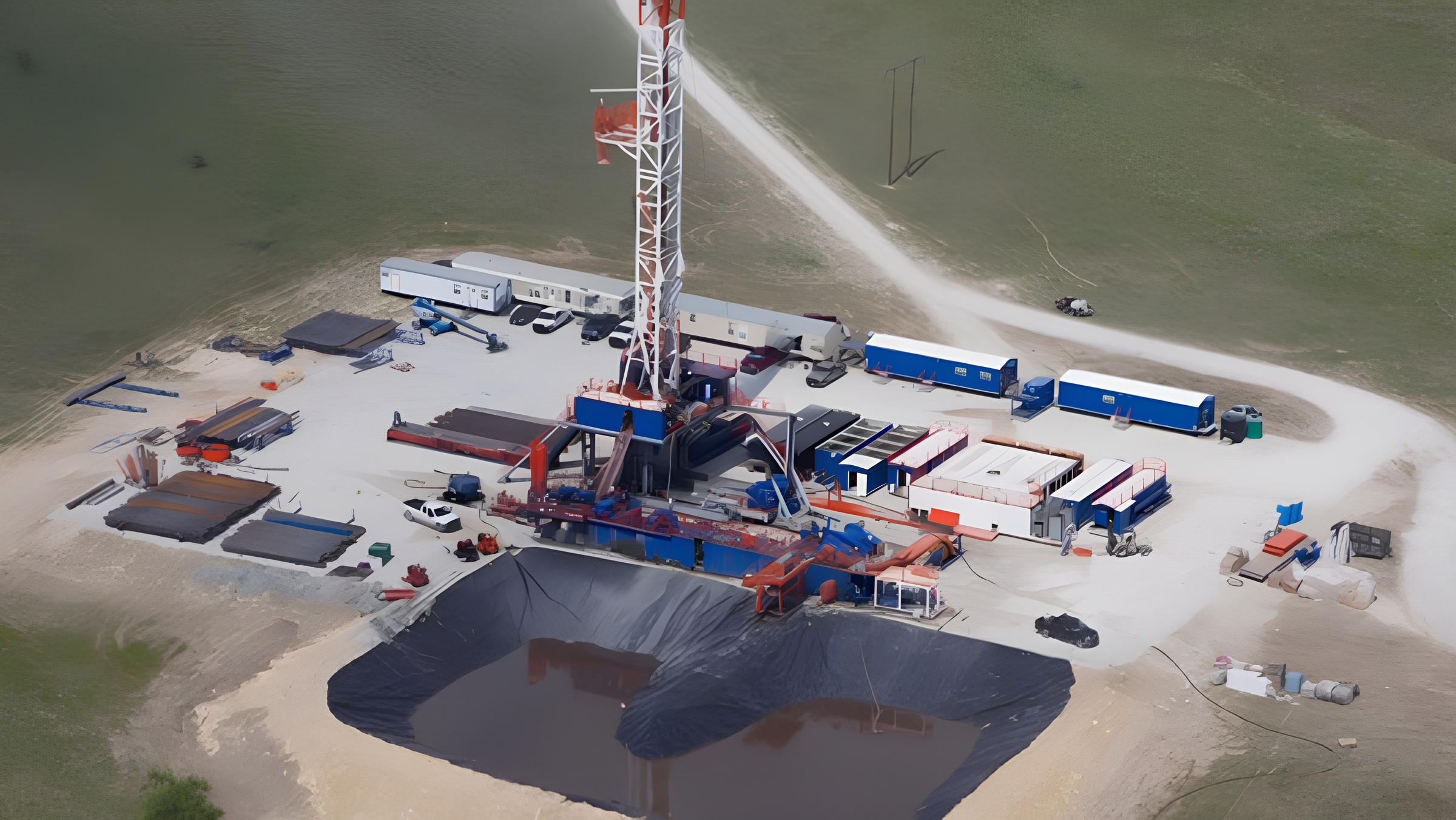

AI and Scale Turn Shale Water Into a Strategic Edge

Automation and consolidation cut costs and risk, turning shale water into a competitive factor for North American producers

17 Dec 2025

Shale water management in North America is entering a more strategic phase as automation and industry consolidation change how operators handle rising volumes of produced water.

Artificial intelligence is playing a growing role. In late 2025, Intelligent Core announced its AI-driven CORE Flow platform, which is now being deployed in the field. The system is designed to monitor, route and manage produced water in near real time, replacing manual coordination and delayed data with automated decision-making. For operators facing higher water volumes and more complex operations, the aim is to reduce disruptions and operating costs.

Automation is advancing alongside consolidation in the water midstream sector. Recent deals, including Deep Blue’s acquisition of Environmental Disposal Systems, show how scale is becoming increasingly important. Larger providers are combining pipeline networks, treatment facilities and disposal wells to offer integrated services. For shale producers, this can mean fewer trucks, higher levels of water reuse and more predictable costs over the life of a field.

Water handling already accounts for a significant share of operating expenses in mature shale basins. As margins tighten, even modest efficiency gains in logistics, treatment and disposal can have a noticeable effect on field economics. Water is therefore being treated less as a waste by-product and more as a system that requires the same planning and technology as oil and gas production.

The shift also has regulatory implications. Automated platforms can help operators respond more quickly to limits on injection pressures and volumes, which are already in place in several basins. Improved data capture and digital records can also simplify compliance reporting and reduce operational and reputational risk.

Adoption is not without challenges. Integrating new digital platforms with legacy equipment can be slow, and some field teams remain cautious about relying on automated decisions. As water infrastructure becomes more connected, concerns around cybersecurity and data reliability are also increasing. Even so, early deployments in the Permian Basin have shown reductions in truck traffic and unplanned downtime.

Together, automation and consolidation mark a turning point for shale water management. Operators that invest early in digital tools and scaled infrastructure may gain an advantage, while those that rely on manual systems face growing pressure as water volumes and regulatory scrutiny rise.

Latest News

6 Feb 2026

Shale’s Water Reuse Push Rewrites Cost and Risk Control4 Feb 2026

AI Starts to Reshape Produced Water Control in U.S. Shale2 Feb 2026

Oilfield Wastewater Finds New Life Online30 Jan 2026

Data Brings Water Into the Shale Planning Equation

Related News

INNOVATION

6 Feb 2026

Shale’s Water Reuse Push Rewrites Cost and Risk Control

TECHNOLOGY

4 Feb 2026

AI Starts to Reshape Produced Water Control in U.S. Shale

INSIGHTS

2 Feb 2026

Oilfield Wastewater Finds New Life Online

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.